Please note that adding this integration will add a $50 monthly fee to your account.

As all the customer information, the contact for the contract, the products sold as well as billing schedule and more is in RunMags, you should invoice in RunMags. This will eliminate the need for any manual double entry and also ensure that your invoices are correct and that you don't miss to invoice anything. Think of RunMags as your revenue generator with account receivable and QuickBooks as your accounting system where you run your Profit and Loss (P&L) as it is there you manage all your vendor invoices.

Important

When setting up your product inventory, add the General Ledger (GL) code from QuickBooks to the product in RunMags so that you can match the revenue and cost in QuickBooks for your magazines and issues.

If you have a complex product structure you can ask us for help to set up the product inventory and sales account matching correctly. Just initiate a support case by emailing support@runmags.com and we'll get in touch with you.

Explanation of the billing process will work in relationship to QuickBooks

This is how the process looks and how the integration to QuickBooks works:

If an advertiser or subscriber pay using their credit card, the processing is handled by RunMags and the Stripe or PayPal account you've set up for this. As the payment is processed, the invoice in RunMags will automatically be marked as paid. Stripe or PayPal will collect the cash and transfer to your bank account. The transfers will not create individual transactions per customer in your bank account but rather transfer a lump sum based on how much money you have received into the account since the last transfer.

If payment is made by check that you received in person or by mail, you will go into the Collection module in RunMags and manually register the payment so that the invoice is marked as paid. When doing this, you can add a reference to the check for future reference. As you drop your checks off at the bank, your bank may or may not scan each check to create individual transactions, but in any event it does not matter. Even if the transaction is entered into your bank account as a lump sum, you have the detailed information in RunMags for reconciliation.

If payment is made by electronic transfer, you will notice the cash in your bank account as an individual transaction or in QuickBooks if you have the bank account sync set up. Depending on your bank they will provide you with more or less information on where the payment came from. You will now go into the Collection module in RunMags and manually register the payment so that the invoice is marked as paid. When doing this, you can add a reference to the electronic transfer number for future reference.

You may or may not be using all three above examples for receiving cash, but in any event you will use the RunMags integration with QuickBooks to generate the appropriate transactions in QuickBooks.

Setting up the QuickBooks integration

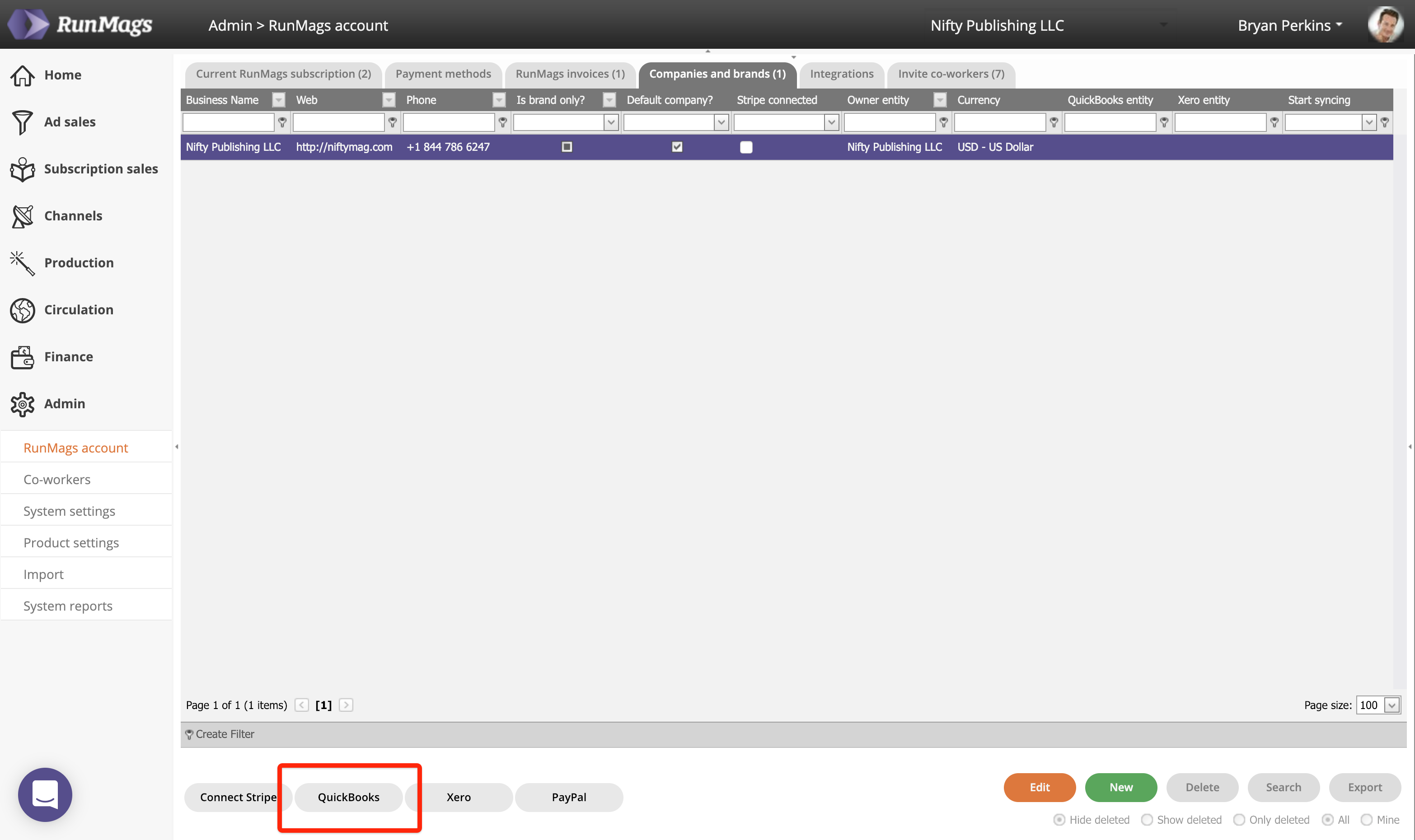

To get the QuickBooks integration set up go to Admin >>> RunMags account.

Then go to the tab names Companies and brands.

Highlight the legal entity you want to set up the integration for and then click the button that says QuickBooks in the lower bottom of the interface. Follow the instructions provided by QuickBooks.